How data visualization tools help in fraud detection: A brief outline

Fraud detection is a critical challenge for businesses, financial institutions, and government agencies. As fraudulent activities become more sophisticated, traditional detection methods often fall short. Data visualization tools provide a powerful solution by transforming complex datasets into intuitive, visual representations. These tools help analysts identify suspicious patterns, anomalies, and trends that may indicate fraudulent behavior.

This article explores the benefits of data visualization in fraud detection, key visualization techniques, real-world examples, and best practices for maximizing effectiveness.

Key benefits of data visualization in fraud detection

- Pattern recognition – Fraud often follows specific patterns. Visualization tools like heatmaps, scatter plots, and network graphs help uncover hidden correlations and unusual behaviors.

- Anomaly detection – Outliers in transaction data, login attempts, or claims can signal fraud. Interactive dashboards highlight deviations from normal trends.

- Real-time monitoring – Dynamic visualizations allow organizations to track transactions and activities in real-time, enabling quicker responses to potential fraud.

- Improved decision-making – Visual summaries simplify complex data, helping investigators and auditors make faster, data-driven decisions.

- Collaborative investigations – Shared dashboards facilitate teamwork among fraud analysts, law enforcement, and compliance teams.

Common fraud detection visualizations

Several visualization techniques are particularly effective in fraud detection:

- Heatmaps – Highlight high-risk areas (e.g., unusual transaction locations).

- Time-series charts – Detect spikes in fraudulent activities over time.

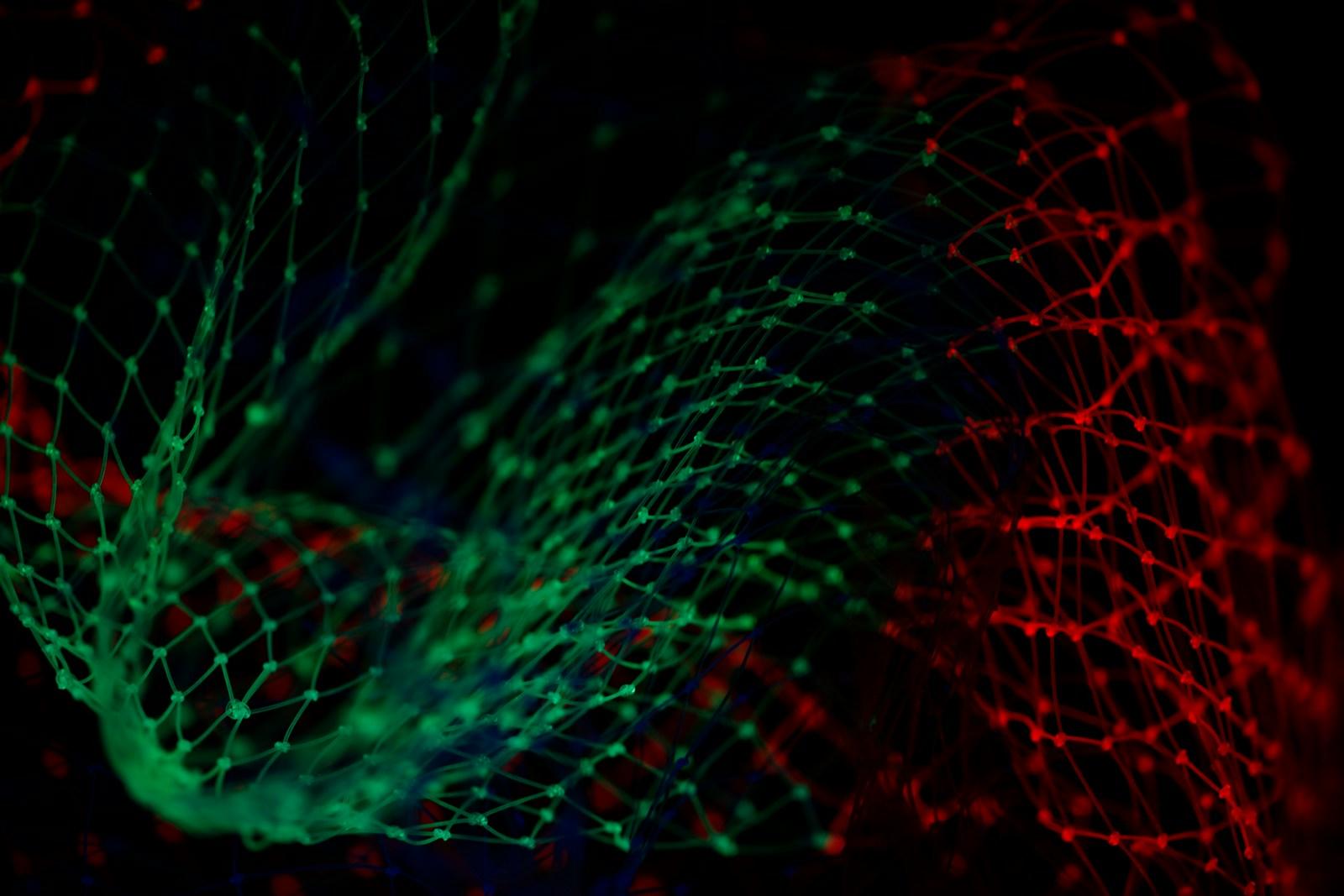

- Network graphs – Reveal connections between fraudsters in money laundering or identity theft schemes.

- Geospatial maps – Track fraudulent transactions across regions.

- Bar/line charts – Compare normal vs. suspicious transaction volumes.

- Scatter plots – Identify outliers in expense claims or insurance fraud.

Case studies & examples

- Credit card fraud detection – Banks use visualization dashboards to monitor transactions in real-time, flagging unusual spending patterns.

- Healthcare fraud – Insurance companies analyze claims data to detect billing anomalies using interactive visual analytics.

- E-commerce fraud – Retailers employ geospatial mapping to identify fake accounts and fraudulent purchases.

- Anti-Money Laundering (AML) – Financial institutions visualize transaction networks to uncover money laundering rings.

Best practices for effective fraud detectionvisualization

- Use interactive dashboards – This allows users to drill down into data for deeper analysis.

- Automate alerts – Set thresholds to flag anomalies automatically.

- Combine multiple data sources – Integrate transaction logs, user behavior, and external threat intelligence within BI and analytics services to enhance fraud detection accuracy.

- Prioritize clarity – Avoid clutter; focus on the most relevant fraud indicators.

- Regularly update models – Fraud tactics evolve, so visualizations must adapt.

Conclusion

Data visualization tools are indispensable in modern fraud detection, enabling organizations to spot irregularities quickly and take proactive measures. By leveraging heatmaps, network graphs, and real-time dashboards, businesses can minimize losses and enhance security. As fraudsters grow more advanced, adopting robust visualization techniques will remain a key defense strategy.

By integrating these tools with AI and machine learning, the future of fraud detection will become even more efficient and precise. Organizations that invest in advanced data visualization will stay ahead in the fight against fraud.

#FraudDetection #DataVisualization #CyberSecurity #AIinFinance #RealTimeAnalytics

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness